Decentralized Finance (DeFi) has seen an explosion of new types of financial products on blockchain. Such as the Yield Farming concept, Bitcoin types encrypted on Ethereum such as WBTC or TBTC, Uniswap and instant loans. Another segment of the crypto space that is very interesting to watch is the elastic supply token or the rebase token itself.

What is Rise Protocol?

The world's most advanced synthetic rebase token, Rise Protocol combines revolutionary tokens and features with the best and latest decentralized financial technology (DeFi). The smart contract has been audited via (professional audit firm) and Shappy from WarOnRugs.

How Rise Protocol works

If the RISE price is higher than the fixed price at 20:00 UTC, the total supply of RISE will increase and everyone will automatically receive more RISE tokens in their e-wallet. If the RISE price is 5% lower than the closing price for three consecutive days at 20:00 UTC, the total supply of RISE will decrease.

Rise Protocol Highlights

The Rebase token was initially tied to Ethereum with a powerful "Super Big Black Hole" deflation mechanism

Fully adapting to market changes and investor behavior, the peg can be changed to any asset or asset class (BTC, DOT, LINK, USDC, etc.) in the future. This will be controlled through administration.

2% of each transaction (except purchases) is distributed instantly and automatically to all Rise holders. You will see your wallet balance increase with each transaction!

1% of each sale is liquidated permanently locked, meaning increasing liquidity, and trading platform Reward for liquidity providers

1% of each sale is automatically distributed to our liquidity providers as a bonus. If you provide liquidity, your Uniswap LP token will automatically increase in value over time.

Token Rise Protocol (RISE) Information

•Token: Rise Protocol (RISE)

• Blockchain: Ethereum

• Hard Cap: 375 ETH

• Total amount of pre-sale: 37,500 RISE

• Total initial stock: 100,000 RISE

• Start of pre-sale whitelisting: February 7, 2021, 20:00 UTC

• Pre-sale for whitelisting ends: February 7, 2021, 21:00 UTC

• Launch of public pre-sale: February 7, 2021, 22:00 UTC

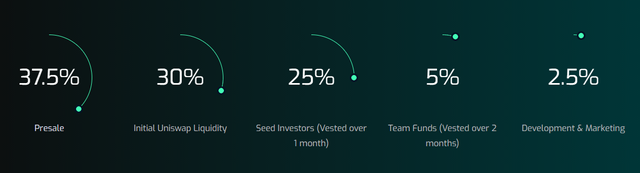

Token allocation

The token supply is distributed as follows:

• Pre-sale - 37.5%

• Initial Uniswap liquidity - 30%

• Seed investors (Tested for more than 1 month) - 20%

• Team fund (Tested for more than 2 months) - 5%

• Development & Marketing- 2.5%

Partner

Rise Protocol is the solution to a real need in DeFi, the project provides a simple solution and has a large number of top projects supporting.

DeFi is increasingly developing, the measures to help maximize the efficiency of capital and make cash flow continuously circulate will be increasingly applied. The Rise Protocol is a piece of the puzzle that helps to solve the problem with today's reduced demand for detection.

For more information please visit the information below:

• Website

• Litepaper

• Telegram

• Twitter

• Medium

• Reddit

• Discord

#$RISE #ieo #blockchain #dot #bounty #defi #Rise #RiseProtocol #RebaseToken #FrictionlessYield #Rebases #DynamicPeg #blackhole #AutoLiquidity #AutoRewards.

Author :

Username: piqulhdt28

Profile Bitcointalk : https://bitcointalk.org/index.php?action=profile;u=1793127

Komentar

Posting Komentar